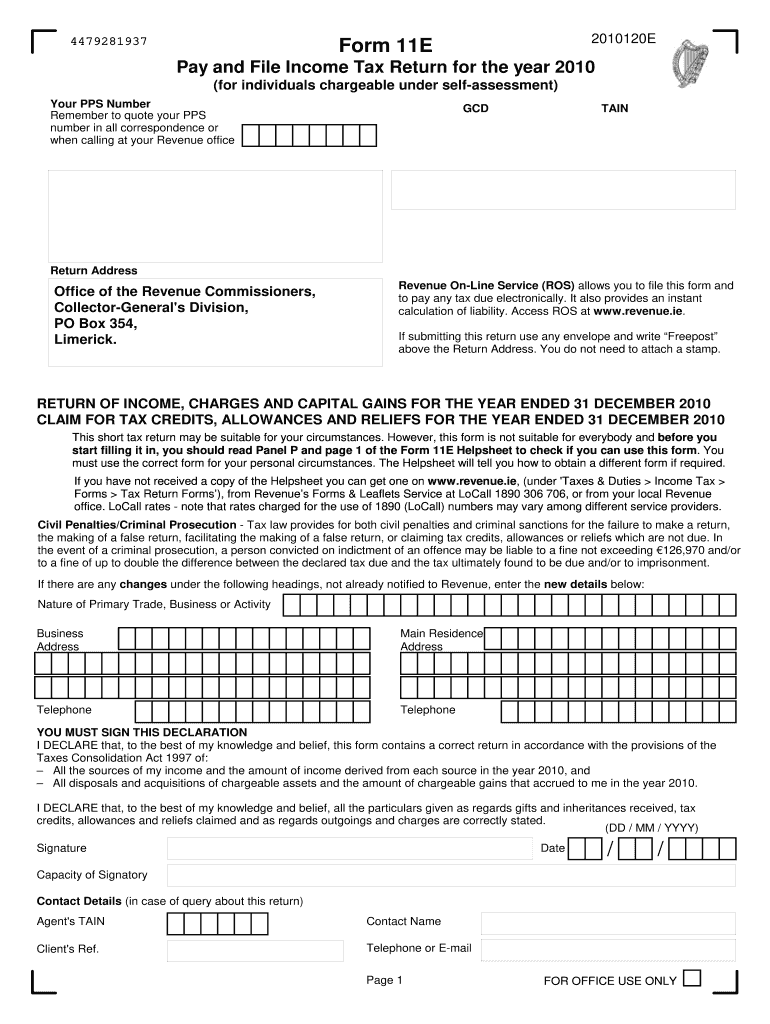

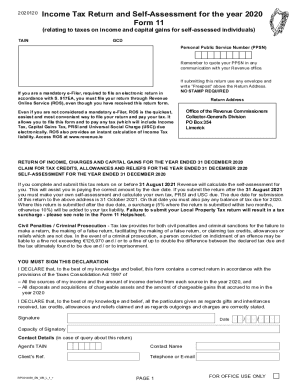

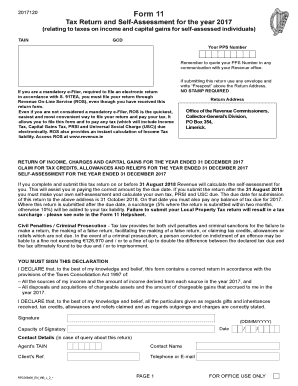

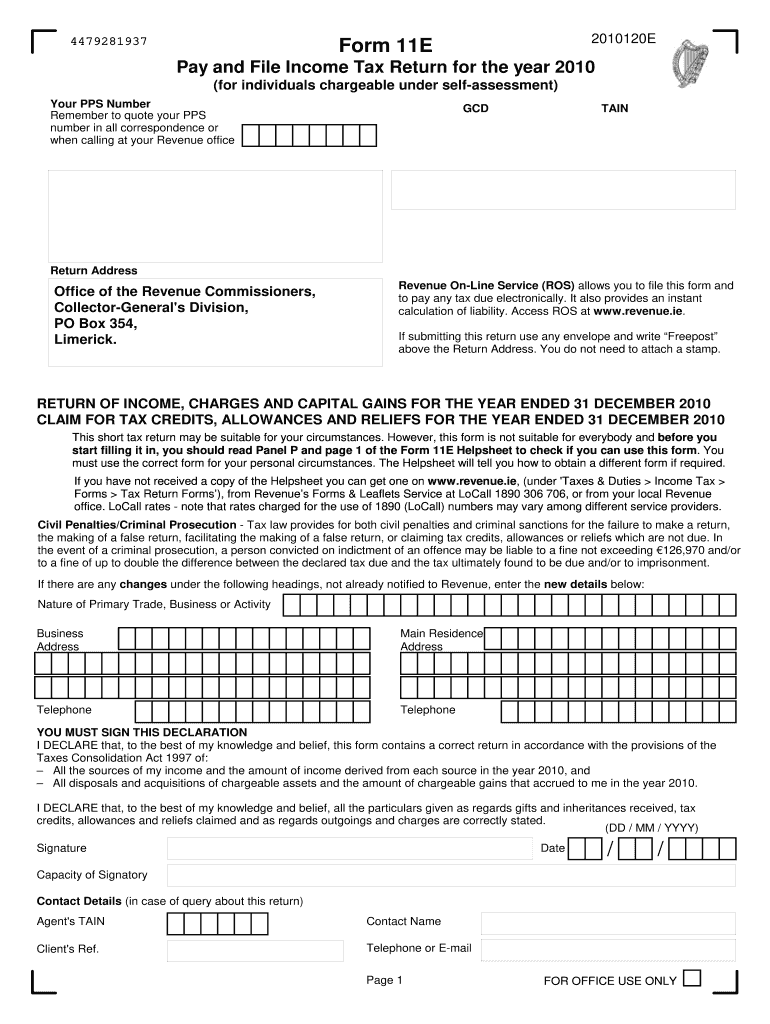

IE Form 11E 2010-2024 free printable template

Get, Create, Make and Sign

How to edit revenue form 11 online

How to fill out revenue form 11

How to fill out revenue form 11?

Who needs revenue form 11?

Video instructions and help with filling out and completing revenue form 11

Instructions and Help about revenue form 11s download

Music hi I'm Kevin back and welcome to first look where we'll be giving you a first look at a new Lenovo product today we're going to be covering the ThinkPad 11 II, and I've got here with me David Harris how you're doing Kevin doing well David is the product manager for the ThinkPad 11 e, so we're gonna talk extensively about all the new but all the new goodness that's right that's right so just a little of overview the concept behind the 11 e is that we wanted to take what we had learned previously in our other education offerings yes and build something new and Andy a new form factor that's right, so we actually went to a lot of our customers and asked where do we go from our X 131a right now my customer said they love the form factor they love for it to be thinner and lighter now but there were some customers who also wanted to take advantage of tablets, but they did want to give up keyboard a little torn right so that that became the genesis of what this product here 11e is we're offering both of the clamshell design and the yoga form factor awesome so best of both worlds the best of both worlds awesome so let's talk a little about you know what we changed like you said we knew we had to make it a little thinner a little lighter so where we add on that yes we challenged our developers, and we were able to actually make this 30 thinner 20 lighter awesome of the same organization specs awesome so yeah well we'll talk about that a lot a little but lets kind of get into some of you know what we think of the key features that were enabling both on the clamshell and the yoga flip around models for education with these yeah so obviously with the addition of the yoga mode we have the ability to do multi-touch on this device where we had that before, so that certainly helps some customers we also have the activity LED that is that's a carryover from our previous products yeah that allows the teachers stand in front of a sea of students determinate they're all on the same page or not whether they're all on wireless or not all Wireless yeah I know you folks will be able to see it from here, but it's just right here there's a nice wide LED on the back, so a teacher can look out across a sea of students and see who's doing what they're supposed to be doing in the end otherwise yes, yes yeah we've got the full 44 mode multimode enablement on the yoga models yes right, so we've got our stand mode over here we've got our laptop mode yep we've got our tent mode yeah and then all we have to do is pick this up pull that around, and we're in full tablet mode, and it works great for education whether students are kind of in this mode consuming media or whether they're in a content creation mode and using the laptop or in a mode where they're actually reading a book, and you need a whole something right absolutely all right, so you know you talked about durability I know that's been a key focus for us in the education models yes I did some think pads are known...

Fill form 11 pdf : Try Risk Free

What is form 11e?

People Also Ask about revenue form 11

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your revenue form 11 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.