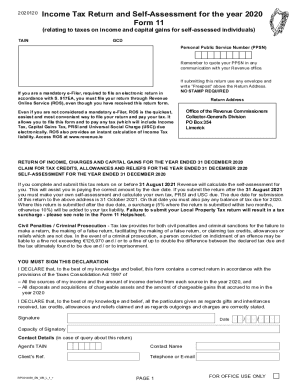

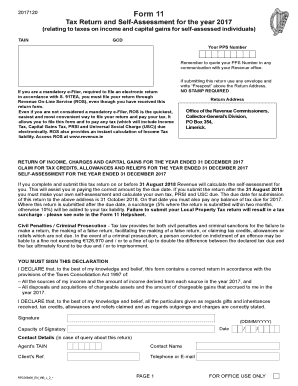

IE Form 11E 2010-2026 free printable template

Show details

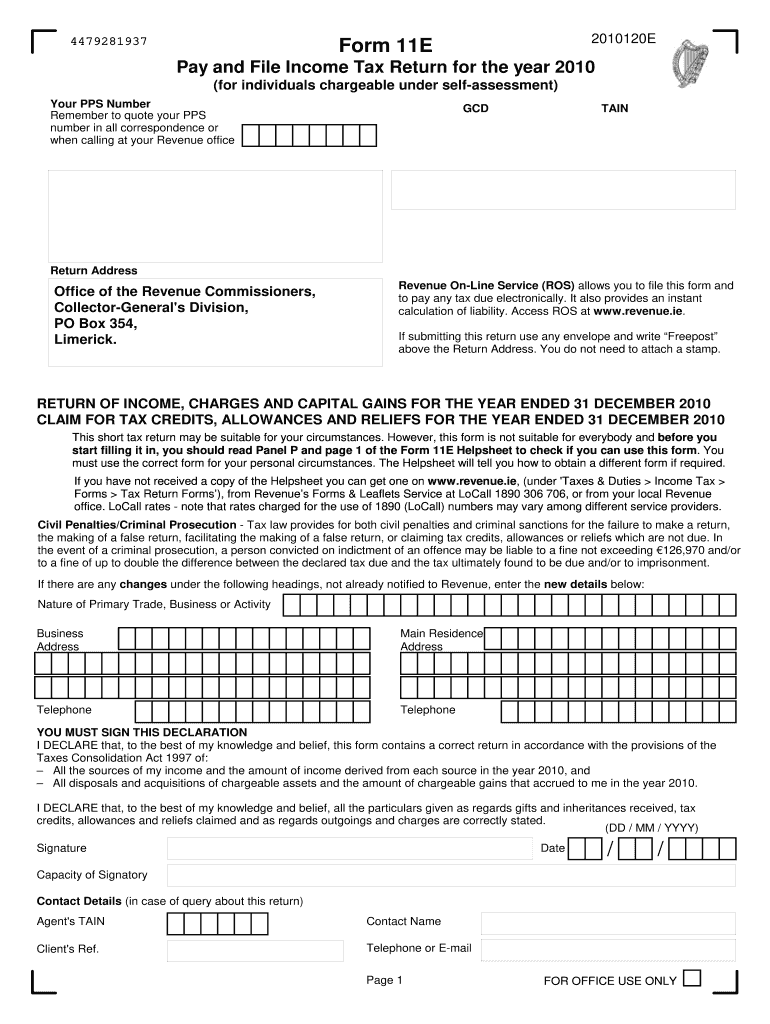

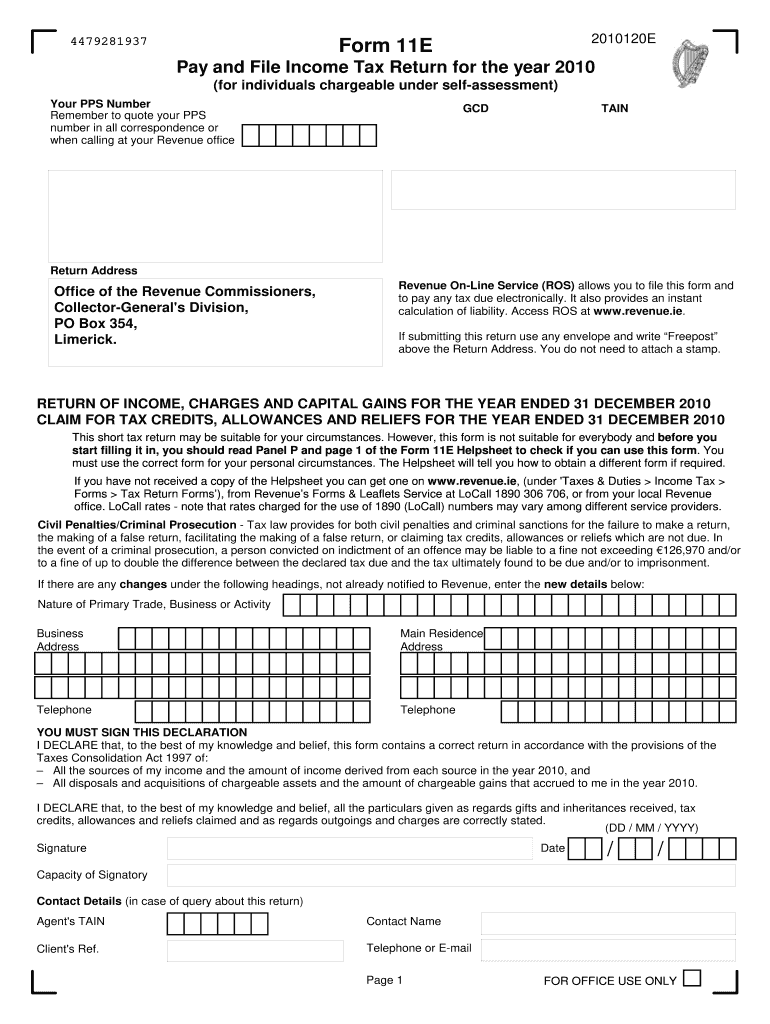

E. under Chapter 2A of Part 15 Form 11E is not for you. does not apply to either you or your spouse. However this form is not suitable for everybody and before you start filling it in you should read Panel P and page 1 of the Form 11E Helpsheet to check if you can use this form. You must use the correct form for your personal circumstances. The Form 11E Helpsheet page 4 lists the items omitted from this form which are in the Form 11. If you have anything to declare in relation to any of the...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign revenue form 11

Edit your file return revenue form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 11 short version form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit the purpose of ie form expenses facilitating proper tax assessment online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit what is ie form 11e entity's operations for tax purposes. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 11e sketch download form

How to fill out IE Form 11E

01

Obtain the IE Form 11E from the appropriate regulatory authority or their website.

02

Begin filling out the form by entering your personal details such as name, address, and contact information.

03

Provide the necessary identification details, including your tax identification number or social security number.

04

Complete the sections that require information about your business or the entity that the form concerns, including registration numbers and addresses.

05

Fill in the specific information required for the purpose of the form, such as the type of transaction or declaration being made.

06

Review all filled sections for accuracy and completeness before submission.

07

Sign and date the form where required, ensuring that all declarations are understood and agreed upon.

08

Submit the completed form according to the guidelines provided, whether online or through mail.

Who needs IE Form 11E?

01

Individuals or entities engaged in activities that require official reporting or declarations to the relevant authorities.

02

Businesses that must provide information regarding compliance with taxation or regulatory requirements.

03

Consultants and advisors acting on behalf of clients needing to file this form for regulatory purposes.

Fill

revenue file return

: Try Risk Free

What is form 11e?

The Simple Procedure. Special Measures Review. Application. This is a Special Measures Review Application.

People Also Ask about revenue forms

How do I save a Form 11 as a PDF?

Sign into ROS (Revenue Online Services) Select 'Revenue Record' Select the document called 'Form 11' for the year you require (only click once here) Select control and P to save the document as a PDF.

How do I get Form 11?

A copy of the Form 11 Helpsheet and a “Guide to Completing 2021 Pay & File Self-Assessment Returns” are available from Revenue's website .revenue.ie, or from Revenue's Forms & Leaflets Service at +353 1 738 3675.

How do I upload documents to Revenue?

You can access the service through myAccount: select 'Upload Supporting Documents' on the 'Manage My Record' card. click on 'Add a new document' select the category for which you wish to upload documentation. browse for your file. click 'Upload'.

What is Irish Income Tax Return Form 11?

What is a Form 11? A Form 11 is otherwise known as an Income Tax return in Ireland. These income tax returns must be submitted to Revenue annually within the filing deadlines. In this guide, you'll learn what you need to do ahead of the 2022 Form 11 Income Tax return deadline.

How do I download a prepopulated form 11?

On the "My Services" page, click on the "Download Pre-populated Returns" button under “Other Services” at the bottom of the page. Under “Tax Type” click on the dropdown arrow and select “Income Tax”, “Return Type” should be “Form 11” and the “Tax Regn./Trader No.” will be your Income Tax registration number.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form 11e online?

With pdfFiller, the editing process is straightforward. Open your what is 11e in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I edit form 11 on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign revenue ireland form 11 right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How can I fill out k11 form on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your 11e sketch. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is IE Form 11E?

IE Form 11E is a specific form used to report income and expenses related to an entity's operations for tax purposes.

Who is required to file IE Form 11E?

Entities that meet certain income thresholds or operational criteria as defined by tax regulations are required to file IE Form 11E.

How to fill out IE Form 11E?

To fill out IE Form 11E, gather all relevant financial data, complete each section of the form accurately, and ensure that all figures are properly calculated and substantiated.

What is the purpose of IE Form 11E?

The purpose of IE Form 11E is to provide tax authorities with a detailed account of an entity's income and expenses, facilitating proper tax assessment.

What information must be reported on IE Form 11E?

IE Form 11E must report details such as gross income, allowable deductions, net income, and other relevant financial information of the entity.

Fill out your IE Form 11E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

11e Sketch Download Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to 11e sketch application form

Related to ros form 11

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.